san mateo tax collector property tax

See Property Records Tax Titles Owner Info More. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Property Tax Search Taxsys San Mateo Treasurer Tax Collector

Whether you are already a resident or just considering moving to San Mateo to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

. With approximately 237000 assessments each year the Assessor Division creates the official record of taxable property local assessment roll shares it with the County Controller and Tax Collector and makes it publicly available. Property Tax Payments can now be made via PayPal with an online service fee of 235 Beginning March 15 2022. Center 1600 Pacific Hwy Room 162 San Diego CA 92101.

San Mateo County Tax Collector. If you have not paid yet you will soon be getting a Treasurer-Tax Collector reminder notice in the mail. 650 363 - 4580.

California COVID-19 Rent Relief. You also may pay your taxes online by ECheck or Credit Card. Millions of Property Records Are Accessible to the Public.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in San Mateo County. 650 363 - 4944. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are accurately distributed to taxing agencies and that any tax refunds due are processed in a timely manner.

Click here for Property Tax Look-up. Treasurer Tax Collector. Learn all about San Mateo real estate tax.

555 County Center - 1st Floor Redwood City CA 94063. The median property tax on a 78480000 house is 580752 in California. More than 98 of San Diego property owners have paid their 2021-2022 property taxes.

Mail Tax Payments to. Property Tax Reminder Notices. Masks are optional for visitors of County.

Look Up Any Address in the USA. San Francisco CA 94145-0878. The median property tax on a 78480000 house is 824040 in the United States.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. 2019 2022 Grant Street Group. Treasurer-Tax Collector San Diego County Admin.

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. Search Any Address 2. In fulfilling these services the Division assures that the County complies with necessary legal.

Sandie Arnott San Mateo County Tax Collector. Announcements footer toggle 2019 2022 Grant Street Group. Ad Get Record Information From 2022 About Any County Property.

Get Free Testing Fliers And Social Media Graphics County Of San Mateo Ca

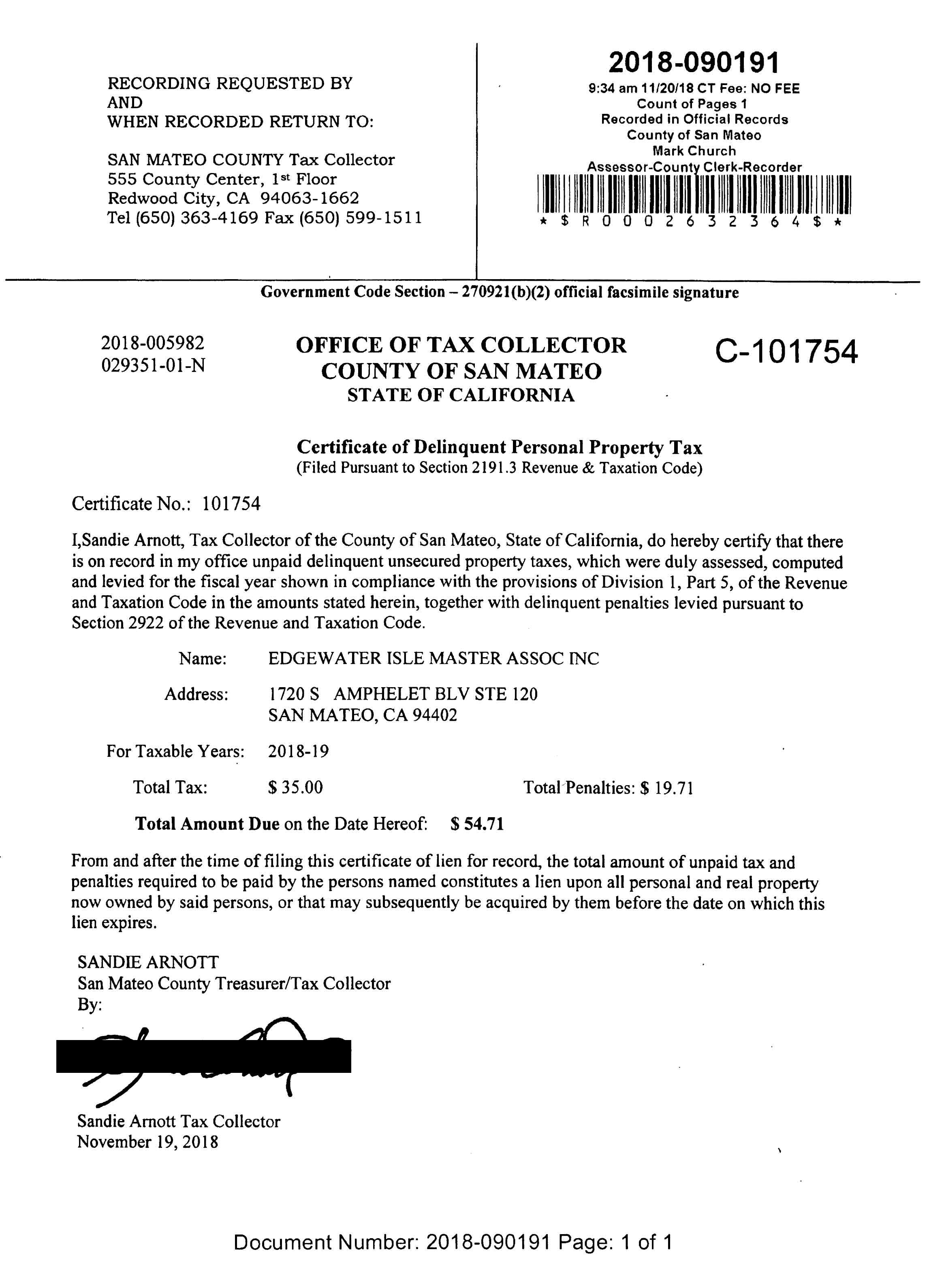

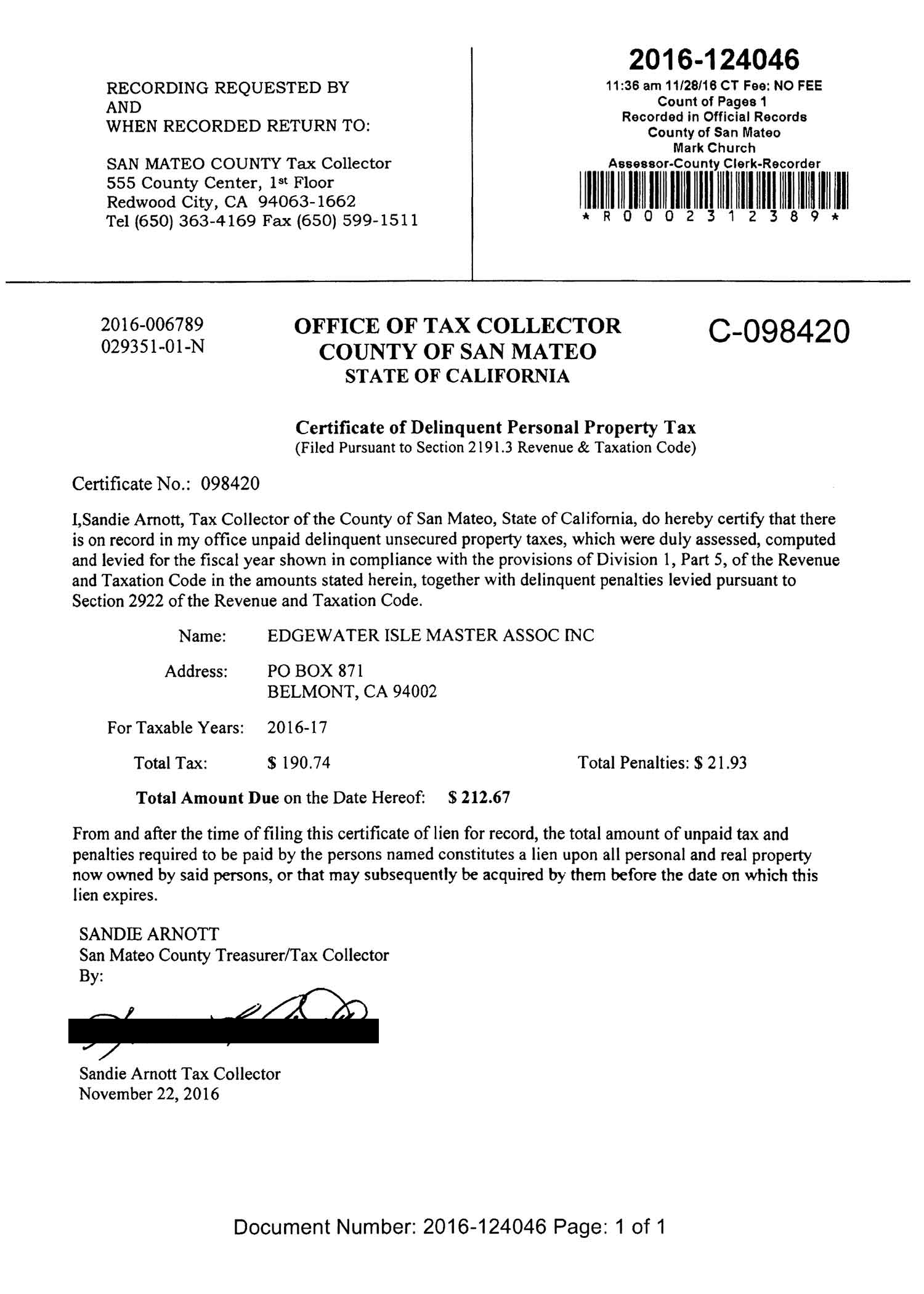

San Mateo County Issues Liens Against Master Association

Pay Property Taxes Online County Of San Mateo Papergov

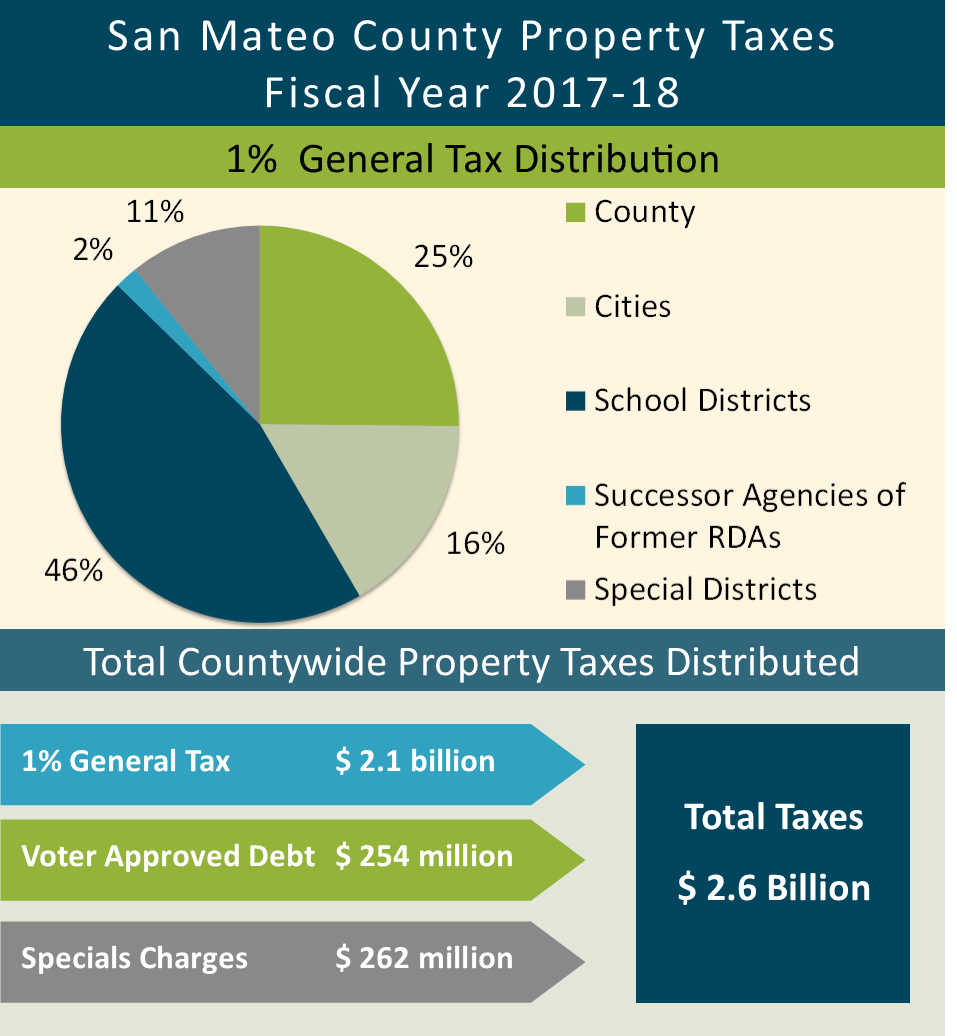

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

Charges On Property Tax Bill Montara Water Sanitary District

California Public Records Public Records California Public

San Mateo County Issues Liens Against Master Association

.png?upscale=True)

Job Opportunities Sorted By Job Title Ascending Join The County Of San Mateo

Fine Missouri Fuel Tax Refund Form 4925 In 2022 Tax Refund Tax Refund

Green Infrastructure Planning And Building

County Controller Publishes Property Tax Highlights For Fy 2021 22 County Of San Mateo Ca